The Goods and Services Tax (GST) is a tax levied on the supply of goods and services in India. The GST is a comprehensive, multi-stage, destination-based tax that is levied on every value addition. It has replaced many indirect taxes previously levied by the central and state governments. Here is a step-by-step guide to applying GST in India:

Register for GST: The first step is to register for GST. You can do this online through the GST portal (https://www.gst.gov.in/). You will need to provide your PAN (Permanent Account Number), email ID, and mobile number to register. Once you have completed the registration process, you will be assigned a unique GST identification number (GSTIN).

Determine your GST liability: The next step is to determine your GST liability. You will need to calculate the GST payable on the supply of goods or services. The GST rate varies depending on the type of goods or services being supplied.

Issue invoices: The next step is to issue invoices. The invoice must include the GST identification number (GSTIN) of the supplier and the recipient, the details of the goods or services supplied, the value of the goods or services, and the GST rate.

File GST returns: The next step is to file GST returns. You will need to file monthly, quarterly or annual GST returns depending on your turnover. GST returns can be filed online through the GST portal.

Pay GST: The final step is to pay GST. You can make payments online through the GST portal using internet banking or credit/debit cards.

It is important to note that the GST system is a complex one, and it is advisable to seek the help of a tax professional or GST practitioner for assistance with registration, compliance, and filing of returns.

In GST Registration GST Liability Calculation GST Invoicing GST Returns Filing GST Payment Indirect Taxes in India GST Portal GST Practitioner GST Compliance

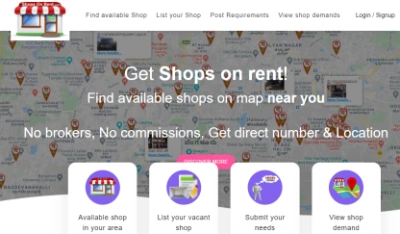

No brokers, No commissions, Get direct tenant on ShopsOnRent.com

No brokers, No commissions, Get direct tenant on ShopsOnRent.com

0 comments:

Post a Comment